The evolution of retail media: trends to watch

Retail media is already the fastest-growing advertising channel in the United States ($52.3B in 2024) and is expected to top $176B globally, by 2028.

As retail media budgets and resources surge, competition intensifies, making it increasingly challenging to maximize return on ad spend (ROAS).

Therefore, reaching your retail media goals will require innovation and a willingness to stay ahead of the most important trends that emerge this year.

For example, True Self-Service capacities in retail media, supported by AI, create opportunities for third-party Marketplaces and smaller businesses.

As a result, with more sellers investing, on-site competition is intensifying, leading brands to adopt omnichannel solutions in order to prevent saturation.

That said, to fully leverage off-site campaigns, advanced measurement tools are crucial for precise performance analysis and optimization.

To better understand these trends and provide actionable context, we spoke with our team of in-house retail media experts. Here are the most important trends in retail media.

Top retail media trends

1. We’ll see the rise of True Self-Service:

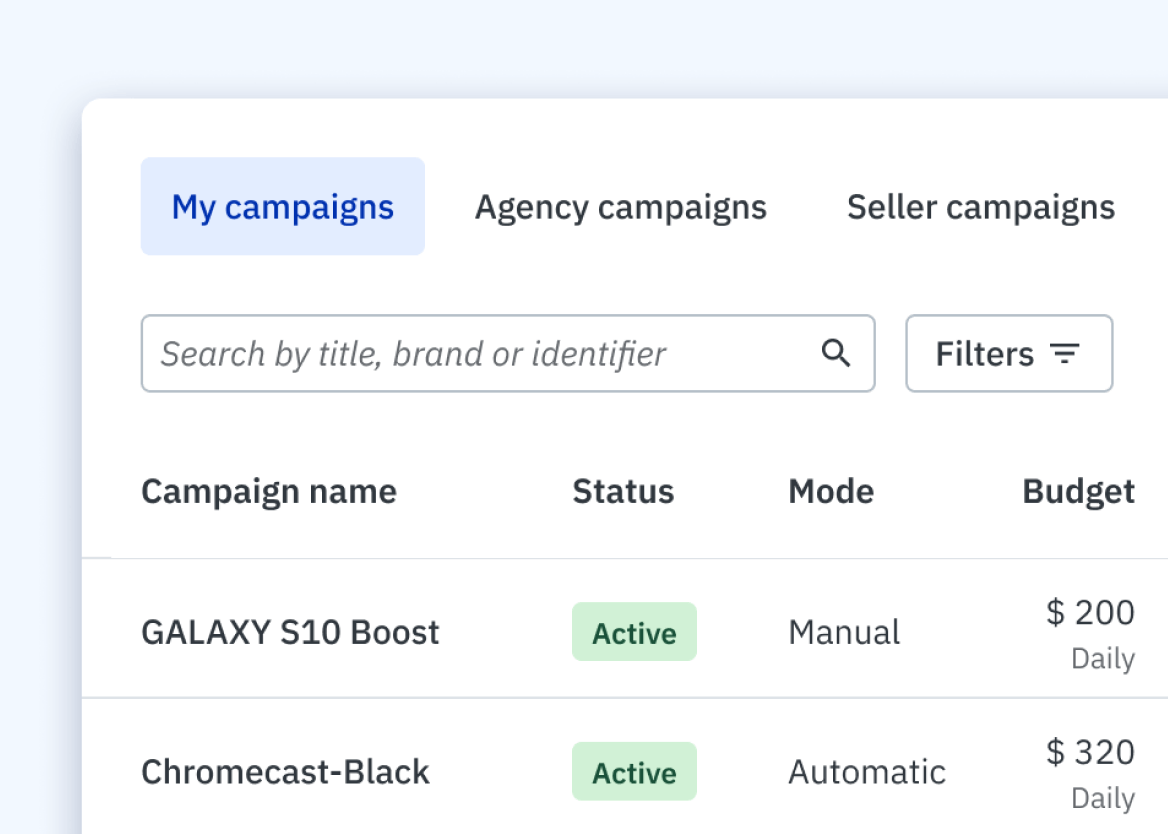

While many platforms offer basic self-service, few deliver True Self-Service that gives both retailers and advertisers complete flexibility and control.

In 2025 True Self-Service will rise.

For retailers, True Self-Service means having full control over ad inventory, including:

Setting floor CPCs (or CPMs).

Managing ad inventory, meaning that retailers can create and manage ad-placements and formats in real time.

Controlling advertiser capacities (i.e. keyword blacklisting or targeting management).

For advertisers — and of course in-house campaigns — it means providing the flexibility to:

Adjust CPCs and CPMs at both the AdGroup and product level.

Manage attribution models in real time.

Utilize advanced automated targeting for display ads.

Access cross-sell capabilities to promote complementary products, seamlessly.

Access advanced data on their campaigns, competition and forecasts in a self-service experience.

For advanced users that want to run highly-customized campaigns, deep levels of flexibility and control are necessary for any self-service solution. But for novice users who just want to easily boost their visibility and sales, it can be overwhelming.

Therefore, AI-powered automation will be essential for True Self-Service. AI can optimize bids, placements, and creative assets in real time, while providing automated recommendations to simplify campaign creation.

Most importantly: AI enables ad personalization — tailoring ads to individual shopper preferences — which boosts engagement and conversion rates. This ensures that all advertisers, from novices to retail media experts, can manage campaigns effectively.

2. Barriers to entry in retail media will ease for marketplaces and long-tail sellers:

The rapid growth of marketplaces and retail media are intertwined.

For instance, marketplaces saw 30% growth in 2024, while retail media is projected to account for 20% of all digital advertising dollars, globally, in 2025.

This exponential growth is being fueled by accessible retail media tools, especially AI-powered self-service platforms that enable greater participation from third-party (3P) and long-tail sellers. These AI-capabilities also make it easier for novice sellers in retail media to launch campaigns and quickly see positive sales results.

For instance, Amazon reports that third-party sellers’ investments in retail media are growing twice as fast as first-party sellers, with long-tail sellers spending three times more.

Our intuition is that marketplaces that successfully make retail media accessible and appealing to 3P and long-tail sellers will drive a significant increase in ad investments, ultimately transforming their business into pay-to-play models that are similar to Amazon’s or Walmart. The results will further fuel the growth of retail media investments worldwide.

3. The definition of omnichannel will continue to expand:

As the number of sellers grows, competition for visibility intensifies, driving up CPCs and fill rates. Brands are looking for new ways to expand their omnichannel strategies as a result, using the high-qualified data generated by retailers. As brands begin to incorporate a growing number of channels, these three will be the most strategically important:

Social Media: The idea is simple — bring social media users back to eCommerce sites or use retail media data to drive sales directly on social platforms. In 2024, nearly 20% of online sales came from social media, and that number keeps growing. Social networks aren’t just about awareness anymore, but have become powerful conversion tools.

Connected TV (CTV): Highly-targeted video formats are proving to be powerful tools for customer engagement. In 2024, investments in retail media and CTV surged in the U.S., increasing from $800 million to a staggering $3.6 billion. This channel is expected to continue its rapid expansion in the next following years, with a projected $8,6bn in 2027 just in the U.S. The rest of the world is likely to follow this trend quickly, leading to a significant global surge in the year ahead.

Research Online, Purchase Offline (ROPO): Online research has a significant impact on in-store purchasing behavior, with 81% of in-store purchases beginning online. This underscores the need for brands to establish a seamless and consistent purchase-funnel experience. As a result, new companies, such as VusionGroup, are entering this space to help brands maintain control over their unified customer journey.

4. Advanced measurement tools will become a necessity:

Retail media success hinges on robust measurement capabilities. The need for advanced measurement tools will become a necessity as retail media strategies mature and take on new complexity. Included in the most important capabilities are:

Benchmarking: Metrics mean very little without context. For example, 10% growth might feel like an achievement, but it takes on new meaning when shown in the context of a competitor's 100% surge. Being able to benchmark your progress against competitors or industry standards is essential for success and can be easily done in the digital media space. Retailers that provide this level of transparency and make it easy for advertisers to put their metrics in context will attract a significantly larger share of retail media investments. They’ll also be able to encourage advertisers to invest in new KPIs such as share of voice and market share.

Flexible Attribution: Retail media solutions are highly fragmented. With numerous new tech companies entering the market each year and retailers developing their own in-house technologies, obtaining unified data and comparing results across different channels can be challenging. To facilitate result comparison across various retail media interfaces, one feature will become increasingly essential in reassuring and retaining investments from the most skeptical advertisers: Attribution flexibility that enables true apples-to-apples comparisons.

Incrementality: When it comes to judging the success of your retail media strategy, return on ad spend (ROAS) can’t be the only metric you consider. For example, a shopper who makes a purchase after clicking on an ad is not necessarily a win. They may have already intended to buy your product, meaning the click cost you money without generating any additional value. Retailers providing access to features such as A/B testing and period comparison, which more accurately demonstrate the high value of retail media, will attract more investment from advertisers and drive higher revenue for marketplaces. Incrementality will become the most closely watched metric in the coming years, while ROAS might become just another indicator among many.

Holistic Insights: It is essential to compare performance against competitors and across different platforms, but most importantly, it must be done holistically. Every campaign can influence sales, and with the growing number of purchasing channels, consumers are shopping across multiple devices and platforms, including social media, eCommerce websites, and traditional brick and mortar stores. Everything is interconnected, with shoppers increasingly informed, and navigating these channels, in non-traditional ways. To encourage advertisers to allocate budgets to emerging channels, retail media tech solutions must provide a 360-degree view of campaign performance.

Stay ahead of retail media trends

Retail media and marketplaces are no longer separate entities — they are interdependent and fuel each other’s growth.

By providing intuitive self-service platforms, AI-driven personalization, and advanced measurement tools, retailers and advertisers can unlock the full potential of retail media, transforming it into a high-impact revenue engine.

Mirakl Ads embodies this approach, empowering retailers with flexible, intuitive tools and ensuring advertisers, from big brands to long-tail sellers, can thrive.

Stay ahead of this year’s trends in retail media with Mirakl Ads and learn more about growing your marketplace with our retail media eBook.

Download eBook: Unlock eCommerce Growth with Retail Media