The hidden cost of traditional retail: how competitors are growing with marketplace and dropship strategies

In today's competitive landscape, executive leaders are under constant pressure to optimize profits and streamline operations across both brick-and-mortar stores and eCommerce channels. Yet, most are still wasting time on inventory strategies that limit growth potential and increase financial vulnerability.

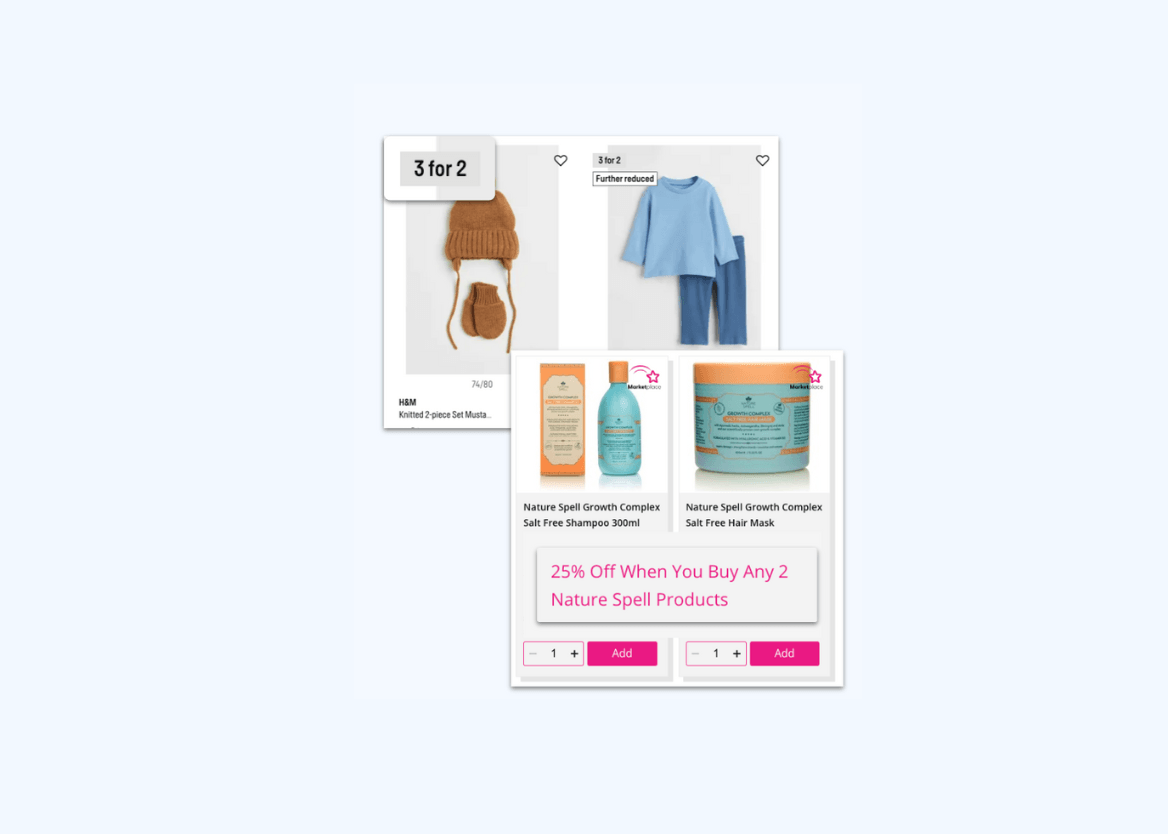

Marketplace and dropship business models present retailers with an opportunity to diversify their product assortments while maintaining financial flexibility. This is particularly crucial in navigating the evolving digital landscape, where consumer preferences shift rapidly.

Adopting a marketplace and dropship platform model requires a comprehensive strategy that includes planning, execution and continued refinement.

As a result, retailers with a marketplace or dropship business have outpaced traditional eCommerce, growing at a rate of 6X faster.

The ability to experiment, adapt to customer feedback and minimize costs related to owned inventory has made them increasingly appealing to retailers globally.

Recently, we’ve seen notable advancements in this trend, with major retailers announcing new or enhanced platform strategies. These brands are strategically leveraging marketplace and dropship models to achieve long-term success.

[Discover exactly how industry leaders are outpacing their competition and how you can implement their proven strategies: The Marketplace & Dropship Index.]

By embracing these platform models, retail leaders are improving operational efficiency, remaining agile in an ever-changing market and effectively meeting the evolving needs of their customers while traditional retailers struggle to keep pace.

The financial flexibility gap

One of the most compelling benefits of a marketplace strategy is the financial flexibility that traditional retail models simply cannot match.

Retailers are strategically navigating low-profit-margin categories by selling third-party products through a marketplace model, and generating revenue through commission-based sales instead of absorbing inventory risk.

This strategic pivot enables retailers to select product offerings that maximize profitability while reducing financial risk.

Marketplace commission rates provide financial advantages by lowering upfront investments and inventory costs while expanding product offerings. This diversifies income streams, reducing reliance on low-margin products and allowing for better resource allocation, increased marketing focus and higher sales volume with healthier profit margins.

Numbers speak for themselves: The average commission rates set by marketplace operators increased slightly from 14.14% in 2022 to 14.68% in 2023. In 2025, major marketplaces like Amazon and Walmart are pushing those rates above 15%.

Even more compelling, commission in high-margin categories, such as luxury apparel and jewelry, reach as high as 25%, creating lucrative opportunities for retailers willing to pivot their digital strategies.

Sell first, buy later

In addition to adopting a marketplace strategy, leading retailers are also doubling down on dropship to accelerate eCommerce growth. This model provides similar scalability options as marketplace models, with greater control over certain components of the sale.

The true cost of your current strategy lies in the opportunities you’re missing. With dropship, merchants never take physical ownership of goods, and don’t purchase products until they’ve already been sold to customers. While merchants remain the seller of record — controlling retail price, margin, promotions and customer service.

Dropship has proven to be particularly effective for handling large, bulky items in key product categories, such as furniture or appliances, which are challenging to stock and ship.

By minimizing warehousing and shipping costs, retailers can offer competitive prices and expand their product offerings without the financial burden of excess inventory. This model opens up new opportunities for retailers to reach a broader audience and adapt to changing market demands.

Customer data as the most valuable asset

One of the most significant advantages of unowned inventory strategies that most retailers fail to fully leverage is customer data. While traditional retailers struggle with fragmented data, marketplace operators gain deeper insights into purchasing behaviors and preferences.

These insights empower retailers to tailor their offerings to meet specific customer needs and also enhance the overall customer experience through personalized marketing and targeted promotions.

By understanding customers on a more granular level, marketplace operators foster stronger relationships, ultimately driving increased loyalty and sales. It not only improves immediate sales performance but also contributes to a longer-term vision of building a customer-centric business model that continuously adapts to evolving market demands.

Beyond traditional retail: act now or fall further behind

By integrating marketplace and dropship platforms, businesses can alleviate profit margin pressure, fostering consistent growth and maintaining financial flexibility. The ability to test, learn and swiftly adapt to changing customer needs, combined with enhanced data collection opportunities, makes these models essential for any retailer aiming to remain competitive.

For retail executives eager to stay ahead, the time to explore the full potential of platform business models is now. Get more marketplace and dropship insights, including how to drive sustained profitability, by downloading our latest research report, here.

Download the Marketplace and Dropship Index Report, now.

Editor’s Note: Originally published on Aug. 20, 2024, this blog was recently republished to ensure all content is up to date and all links remain active.